Today, in the Huffington Post, I posted a document that shows an earlier incarnation of the ABACUS trade (although, not that different from the one that has got the SEC up in arms). I also explained it as well as I could. Head on over and let me know what you think.

Archive for the ‘Quantiative’ category

Inside Goldman’s ABACUS Trade

April 19, 2010Notes and Predictions: The Stress Test

May 6, 2009As the results of the stress test start leaking out slowly, it’s a fun exercise to make some educated guesses/predictions about what the future holds and take note of pertinent facts. As we’ve discussed before, there is a lot to take issue with when considering the results of the stress test at all, especially given the added layers of uncertainty stemming form the limited information provided in the scenarios. So, without further delay, let’s get started.

1. The baseline scenario will prove wholly inadequate as a “stress test.” Please, follow along with me as I read from the methodology (pdf). I’ll start with the most egregious and reckless component of the mis-named baseline scenario (I would rename it the, “if payer works” scenario) : what I will refer to as “the dreaded footnote six.” From the document:

As noted above, BHCs [(Bank Holding Companies, or the firms being stress tested)] with trading account assets exceeding $100 billion as of December 31, 2008 were asked to provide projections of trading related losses for the more adverse scenario, including losses from counterparty credit risk exposures, including potential counterparty defaults, and credit valuation adjustments taken against exposures to counterparties whose probability of default would be expected to increase in the adverse scenario.(6)

[…]

(6) Under the baseline scenario, BHCs were instructed to assume no further losses beyond current marks.

(Emphasis mine.)

Holy <expletive>! In what alternate/parallel/baby/branching universe is this indicative of anything at all? Assume no further losses beyond current marks? Why not assume everything returns to par? Oh, well, that actually was a pretty valid assumption for the baseline scenario. From the document:

New FASB guidance on fair value measurements and impairments was issued on April 9, 2009, after the commencement of the [stress test]. For the baseline scenario supervisors considered firms’ resubmissions that incorporated the new guidance.

(Emphasis mine.)

Thank goodness! I was worried that the “if prayer works” scenario might have some parts that were worth looking at. Thankfully, for troubled banks, I can skip this entire section. (Confidence: 99.9999%)

2. Trading losses will be significantly understated across all five institutions that will need to report them. First, only institutions with over $100 billion in trading assets were asked to stress their trading positions. Second, from the section on “Trading Portfolio Losses” from the document:

Losses in the trading portfolio were evaluated by applying market stress factors … based on the actual market movements that occurred over the stress horizon (June 30 to December 31, 2008).

(Emphasis mine.)

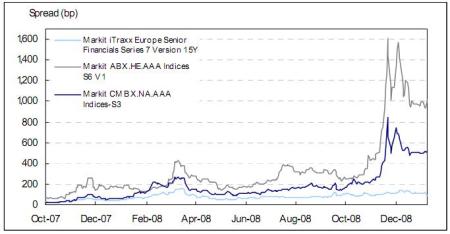

Okay, well, that seems reasonable, right? Hmmmm… Let’s take a look. Here is what some indicative spread movements for fixed income products looked like January 9th of 2009, according to Markit (who has made it nearly impossible to find historical data for their indices, so I’m resorting to cutting and pasting images directly–all images are from their site):

(Click on the picture for a larger version.)

Well, looks like a big move is taken into account by using this time horizon. Clearly this should provide a reasonable benchmark for the stress test results, right? Well, maybe not.

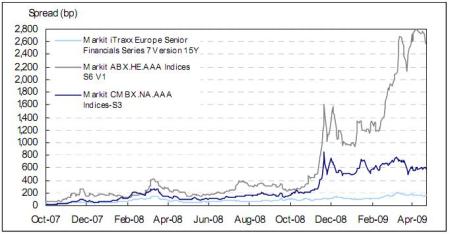

(Click on the picture for a larger version.)

Yes, that’s right, we’ve undergone, for sub-prime securities a massive widening during 2009 already. Also, as far as I can tell, the tests are being run starting from the December 2008 balance sheet for each company. So, if I’m correct, for the harsher scenario, trading losses will be taken on December 2008 trading positions using December 2008 prices and applying June 2008 to December 2008 market movements. For sub-prime, it seems pretty clear that most securities would be written up (June 2008 Spread: ~200, December 2008 Spread: ~1000, Delta: ~800, Current Spread: ~2600, December 2008 to Today Delta: ~1600, Result: firms would take, from December 2008 levels, half the markdown they have already taken).

Also, it should be a shock to absolutely no one that most trading assets will undergo a lagged version of this same decline. Commercial mortgages and corporate securities rely on how firms actually perform. Consumer-facing firms, as unemployment rises, the economy worsens and consumption declines, and consumers default, will see a lagged deterioration that will appear in corporate defaults and small businesses shuttering–both of these will lead to commercial mortgages souring. Indeed we’ve seen Moody’s benchmark report on commercial real estate register a massive deterioration in fundamentals. That doesn’t even take into account large, exogenous events in the sector. Likewise, we see consistently dire predictions in corporate credit research reports that only point to rising defaults 2009 and 2010.

In short, for all securities, it seems clear that using data from 2H2008 and applying those movements to December 2008 balance sheets should produce conservative, if not ridiculously understated loss assumptions. (Confidence: 90%)

3. Bank of America will have to go back to the government. This, likely, will be the end of Ken Lewis. It’s not at all clear that Bank of America even understands what’s going on. First, if I’m correctly reading Bank of America’s first quarter earnings information, the firm has around $69 billion in tangible common equity. Also, it should be noted that the FT is reporting that Bank of America has to raise nearly $34 billion. Now, with all this in mind, let’s trace some totally nonsensical statements that, unlike any other examples in recent memory, were not attributed to anonymous sources (from the NYT article cited above):

The government has told Bank of America it needs $33.9 billion in capital to withstand any worsening of the economic downturn, according to an executive at the bank. […]

But J. Steele Alphin, the bank’s chief administrative officer, said Bank of America would have plenty of options to raise the capital on its own before it would have to convert any of the taxpayer money into common stock. […]

“We’re not happy about it because it’s still a big number,” Mr. Alphin said. “We think it should be a bit less at the end of the day.” […]

Regulators have told the banks that the common shares would bolster their “tangible common equity,” a measure of capital that places greater emphasis on the resources that a bank has at its disposal than the more traditional measure of “Tier 1” capital. […]

Mr. Alphin noted that the $34 billion figure is well below the $45 billion in capital that the government has already allocated to the bank, although he said the bank has plenty of options to raise the capital on its own.

“There are several ways to deal with this,” Mr. Alphin said. “The company is very healthy.”

Bank executives estimate that the company will generate $30 billion a year in income, once a normal environment returns. […]

Mr. Alphin said since the government figure is less than the $45 billion provided to Bank of America, the bank will now start looking at ways of repaying the $11 billion difference over time to the government.

(Emphasis mine.)

Right around the time you read the first bolded statement, you should have started to become dizzy and pass out. When you came to, you saw that the chief administrative officer, who I doubt was supposed to speak on this matter (especially in advance of the actual results), saying that a bank with $69 billion in capital would be refunding $11 billion of the $45 billion in capital it has already received because they only need $34 billion in capital total. Huh? Nevermind that the Times should have caught this odd discrepancy, but if this is the P.R. face the bank wants to put on, they are screwed.

Now, trying to deal with what little substance there is in the article, along with the FT piece, it seems pretty clear that, if Bank of America needs $34 billion in additional capital, there is no way to get it without converting preferred shares to common shares. There is mention of raising $8 billion from a sale of a stake in the China Construction Bank (why are they selling things if they are net positive $11 billion, I don’t know). That leaves $26 billion. Well, I’m glad that “once a normal environment returns” Bank of America can generate $30 billion in income (Does all of that fall to T.C.E.? I doubt it, but I have no idea). However, over the past four quarters, Bank of America has added just $17 billion in capital… I will remind everyone that this timeframe spans both T.A.R.P. and an additional $45 billion in capital being injected into the flailing bank. Also, who is going to buy into a Bank of America equity offering now? Especially $26 billion of equity! If a troubled bank can raise this amount of equity in the current environment, then the credit crisis is over! Rejoice!

I just don’t see how Bank of America can fill this hole and not get the government to “bail it out” with a conversion. The fact that Bank of America argued the results of the test, frankly, bolsters this point of view. Further, this has been talked about as an event that requires a management change, hence my comment on Lewis. (Confidence: 80% that the government has to convert to get Bank of America to “well capitalized” status)

Notes/Odds and Ends:

1. I have no idea what happened with the NY Times story about the results of the “Stress Test.” The WSJ and FT are on the same page, but there could be something subtle that I’m misunderstanding or not picking up correctly. Absent this, my comments stand. (Also, if might have been mean.unfair of me to pick on the content of that article.)

2. The next phases of the credit crisis are likely to stress bank balance sheets a lot more. The average bank doesn’t have huge trading books. However, they do have consumer-facing loan and credit products in addition to corporate loans and real estate exposure. In the coming months, we’ll see an increase in credit card delinquencies. Following that, we’ll see more consumer defaults and corporations’ bottom line being hurt from the declining fundamentals of the consumer balance sheet. This will cause corporate defaults. Corporate defaults and consumer defaults will cause commercial real estate to decline as well. The chain of events is just beginning. Which leads me to…

3. Banks will be stuck, unable to lend, for a long time. I owe John Hempton for this insight. In short, originations require capital. Capital, as we see, is in short supply and needed to cover losses for the foreseeable future. Hence, with a huge pipeline of losses developing and banks already in need of capital, there is likely not going to be any other lending going on for a while. This means banks’ ability to generate more revenue/earnings is going to be severely handicapped as sour loans make up a larger and larger percentage of their portfolios.

4. From what I’ve read, it seems that the actual Citi number, for capital to be raised, is between $6 billion and $10 billion. This puts their capital needs at $15 billion to $19 billion, since they are selling assets to raise around $9 billion, which is counted when considering the amount of capital that needs to be raised (according to various news stories). Interestingly, this is 44% to 55% of Bank of America’s needed capital. This paints a very different picture of the relative health of these two firms than the “common wisdom” does. Granted, this includes a partial conversion of Citi’s preferred equity to common equity.

5. I see a huge correlation between under-performing portfolios and a bank trying to negotiate it’s required capital lower by “appealing” the stress test’s assessment of likely losses in both the baseline and adverse scenarios. As I’ve talked about before, not all portfolio performance is created equal. Citi has seen an increasing (and accelerating) trend in delinquencies while JP Morgan has seen it’s portfolio stabilize. So, for the less-healthy banks to argue their losses are overstated by regulators, they are doubly wrong. It’ll be interesting to see how this plays out–for example, if JP Morgan’s credit card portfolio assumes better or worse performance than Citi and Bank of America.

Why Stress Test Really Means Guesswork

March 15, 2009Well, we’ve heard a ton about stress tests recently. Want some details on what a stress test entails? The Journal has some details about the tests here. Now, as much as I think GDP and unemployment are fine things to project forward for economists, let’s walk through the way one would use this to actually price an asset. Let’s start with something simple, like a 10-year treasury note (note that treasury bond specifically refers to bonds with a 30-year maturity). Here are all the components one would need to stress test the value of a treasury note.

- Characteristics of the note itself: coupon, payment dates, maturity dates, etc.

- What the yield curve would look like at the date you’re pricing the note.

Why would one need to know the shape of the yield curve (term structure of rates)? This is important, in order to “PV” the bond’s cashflows most accurately, one would discount each cashflow by it’s risk–the simplest proxy is to discount each cash flow by the rate of interest one would need to pay to issue a bond maturing on that date. For the government, this rate of interest is the point on the treasury yield curve (actually, the par zero curve) with the same maturity date. An example would be, if I were going to price a cash payment I will receive in two years, and the government can currently issue two-year debt at 5%, I should discount my cash payment (also from the government, since it’s a treasury note) at 5%. Treasuries are the simplest of all instruments to value.

Here’s an example, form the link above, of what a treasury yield curve might look like:

Now, it is completely and totally guesswork to figure out, given unemployment and GDP figures, what the yield curve will look like at any date in the future. Indeed, one can plug these projections into a model and it can come up with a statistical guess… But the only thing we know for sure about that guess is that it won’t be accurate, although it might be close. However, things like inflation will drive the longer end of the yield curve and monetary policy will drive the shorter end, so these certainly aren’t directly taken from the stress test parameters, but would need to be a guess based on those parameters. This is a large source of uncertainty in pricing even these instruments in the stress test.

Next, let’s examine a corporate bond. What would we need for a corporate bond?

- Characteristics of the bond: coupon, payment dates, maturity dates, special features (coupon steps, sinking funds, call schedules, etc.), where in the capital structure this bond sits, etc.

- What the yield curve would look like at the date you’re pricing the bond.

- The spreads that the corporation’s debt will carry at the date you’re pricing the bond.

Oh no. We already saw the issues with #2, but now we have #3. What will this corporations credit spread (interest/yield required in excess of the risk free rate) at the time of pricing? Will the corporations debt, which could trade at a spread of anywhere from 5 to 1500 basis points, be lower? higher? Will the corporations spread curve be flatter? steeper?

Here is a good illustration of what I’m referring to (from the same source as the figure above):

There, the spread is the difference between the purple line and the black line. As you can see, it’s different for different maturity corporate bonds (which makes sense, because if a company defaults in year two, it’ll also default on it’s three year debt.. but the companies’ two year debt might never default, but the company might default during it’s third year, creating more risk for three year bonds issued by that company than two year bonds). It shouldn’t be a surprise, after our exercise above, to learn that the best way to compute the price of a corporate bond is to discount each cashflow by it’s risk (in my example above, regardless of whether the company defaults in year two or year three, the interest payments from both the three year and two year debt that are paid in one year have the same risk).

Well, how does one predict the structure of credit spreads in the future? Here’s a hint: models. Interest rates, however, are an input to this model, since the cost of a firm’s borrowing is an important input to figuring out a corporation’s cashflow and, by extension, creditworthiness. So now we have not only a flawed interest rate projection, but we have a projection of corporate risk that, in addition to being flawed itself, takes our other flawed projections as an input! Understanding model error yet? Oh, and yes unemployment and the health of the economy will be inputs to the model that spits out our guess for credit spreads in the future as well.

Next stop on the crazy train, mortgage products! What does one need to project prices for mortgage products?

- Characteristics of the bond: coupon, payment dates, maturity dates, structure of the underlying securitization (how does cash get assigned in the event of a default, prepayment, etc.), etc.

- What the yield curve would look like at the date you’re pricing the bond.

- The spreads that the debt will carry at the date you’re pricing the bond.

- What prepayments will have occurred by the date you’re pricing the bond and what prepayments will occur in the future, including when each will occur.

- What defaults will have occurred by the date you’re pricing the bond and what defaults will occur in the future, including when each will occur.

Oh crap. We’ve covered #1-3. But, look at #4 and #5 … To price a mortgage bond, one needs to be able to project out, over the life of the bond, prepayments and defaults. Each is driven bydifferent variables and each happens in different timeframes. Guess how each projection is arrived at? Models! What are the inputs to these models? Well, interest rates (ones ability to refinance depends on where rates are at the time) over a long period of time (keep in mind that you need rates over time, having rates at 5% in three years is completely different if rates where 1% or 15% for the three years before). General economic health, including regional (or more local) unemployment rates (if the south has a spike in unemployment, but the rest of the country sees a slight decrease, you’ll likely see defaults increase). And a myrid of other variables can be tossed in for good measure. So now we have two more models, driven by our flawed interest rate projections, flawed credit projections (ones ability to refinance is driven by their mortgage rate, which is some benchmark interest rate [treasuries here] plus some spread, from #3), and the unemployment and GDP projections.

I will, at this point, decline to talk about pricing C.D.O.’s … Just understand, however, that C.D.O.’s are portfolios of corporate and mortgage bonds, so they are a full extra order of magnitude more complex. Is it clear, now, why these stress tests, as they seem to be defined, aren’t all that specific, and potentially not all that useful?

Another “Holy Shit!” Moment in Compensation: The P.A.F.

December 19, 2008Wow. Seriously, wow…

This year, up to 80% of the stock portion will come via what Credit Suisse is formally calling a “Partner Asset Facility,” of the illiquid assets, largely corporate loans.

Bankers won’t receive a return on the PAF program for eight years, although they can start to collect some of the principal in 2013. If the firm finds outside buyers for the assets, it will pay the proceeds to itself first, then provide the rest to employees.

The PAF applies only to senior bankers within the firm’s investment bank, which includes merger advisory, capital markets and leveraged finance. Those in Credit Suisse’s private bank and asset-management division aren’t subject to the PAF.

I’m going to play both sides of this one… But, how do you know it’s a good move? Hiede Moore’s post, in the next line, offers the proof:

The announcement elicited livid reactions from senior bankers, many of whom questioned whether it was legal. Many said they believed they were being unfairly punished for risky assets bought by colleagues in distant parts of the firm.

I’m not crying for these bankers, exactly, but they missed the point. To be honest, it’s a tremendous incentive for everyone to work together for the good of the firm. These same “livid” investment bankers, I’m sure, have been pushing transactions onto their counterparts in capital markets and trading for years. I know this, specifically of C.S.F.B. Their investment bankers would constantly use the “relationship” reason for doing a given transaction that resulted in real estate exposure for their firm (or leveraged finance commitments). So bankers, as a whole, shouldn’t say they are being unfairly punished for their colleagues decisions to make loans that they asked them to make. Now those bankers will not push loans they think might make it into their compensation! (There was a rumor that something like this happened a long time ago at Salomon Brothers.)

Now, why might this be a bad ideas? Honestly, all the reasons are highly technical. First, the investment is much longer dated than normal equity: first principal distributions come in 2013 and the investment will be zero-return for 8 years. This is a bit unfair, as the vesting and return of cash should be similar to normal equity plans if employees are given no notice. It’s only polite as it concerns things like paying college tuition. That being said, this is a program for senior employees and, thus, they should have planned for bad times and not gambled with their entire lifestyle. The two largest issues, though, are where the firm is using this to their advantage instead of being “just” about it. First, Credit Suisse pays itself before employees. That seems tacky.. pro-rata, maybe? Even pro-rata withe the firm counted more… Second, this makes C.S.F.B. employees much less mobile. When a bank is trying to figure out how to make the bankers being recruited from C.S.F.B. whole on what they lose when they depart their current firm (standard practice), it’s likely that their P.A.F. holdings will be valued at, or near, zero.

Now, despite the problems, I think this is a great lesson and a fair mechanism. And, unlike the clawback, if the firm loses money on the investment, so are the people getting paid in P.A.F. units… So you don’t have to worry about going after an employee, they get reduced along with shareholders.

How We Got a Corporatocracy

November 17, 2008With all these bailout (banks, A.I.G., Bear Stearns, and, coming soon, autos!) it’s a wonder how we got to this point. Well, I found an interesting statistic. Taken from the history of the S&P 500’s top components and G.D.P. data we find out that the growth rate of the largest companies (A.I.G. and Citi were part of this group in 2006) has outpaced our economy by 6% annually. Stated another way, the market cap of the top 10 components of the S&P 500 has grown by, on average, 9.4% per year and the economy, as measured by G.D.P., has grown by around 3% per year. This data covers 27 years.

Now, I’m no math genius, but when you have a subset of the economy growing much faster than the economy, it points to a super-concentration of risk. Especially when the system is so inter-connected, perhaps the issue is that some companies became too big, ya think?

This sort of growth is a perfectly natural as a corollary to pay issues and other things. If I’m an executive, and I make money based on earnings, and I get paid in stock, then why not buy my competitors to enlarge my company and increase earnings, eliminate competition to expand margins and create more room for error in execution of business strategies, and use my newly-created larger company to invest even more in the business lines that are producing the best quarterly results? Well, I would! And they did.

But, if we are looking for stability in the system, and we really want the market to work wonders, then we want something different. We want lots of smaller, nimble competing businesses that are constantly keeping margins low and product innovations high. We do not want two or three super-sized businesses that are stable in their market share and merely looking to increase earnings through incremental improvements, and not innovation (G.M.? Ford? Chrysler? I’m looking at you). We don’t want an entire industry to consolidate to the point where they all start following each others innovations so that they can all go down with the ship if any one of them is wrong (Investment banks? Bear? Lehman? I’m looking at you now). And, as a taxpayer, I wouldn’t want a decline in the economy, when all businesses suffer, to jeopardize a set of companies that are too big to fail and not drag the economic state down with them–I would have to bail them out when I’m hurting most.

Those of you that are math geniuses know what comes next … “=><=” (or “⊥”).

I guess we know who won out now. Maybe our leaders should figure out how to prevent this kind of consolidation. They do it with banks (obviously they took a very narrow view there).

In The Year 2010: C.D.O. Edition

October 21, 2008In another installment of the series called “In The Year 2010″ I will sit here and guess what will be going on by the end of 2010 with respect to various products. (Inspired by the Conan O’Brian skit “In The Year 2000″). This is a thought experiment, nothing more.

This edition, as the title would seem to suggest, is about C.D.O.’s. Please sit down, because I’m about to argue something very counter-intuitive. C.D.O.’s will be alive and well in the year 2010. Now, I’m willing to claim this victory on a technicality–corporate C.D.O.’s are still being issued. Now, safe in my assured technical victory, I’ll go farther out on the limb

It’s somewhat instructive to understand what have been the various motivations behind the C.D.O. market, historically (some of these obviously no longer exist)…

- There was the reach for yield. If one could get AAA C.D.O.’s for a higher yield than other AAA bonds, it was a no brainer. Both were AAA, obviously! No extra risk.

- A highly customized risk profile. If I looked at a pool and thought 6% of the balance was going to written off, but no more, I could buy the 7%-10% tranche and get a higher return. Obviously this higher return would need to match whatever threshhold I established, but that was most likely related to the market anyway. Some people referred to this as taking a position in the collateral with leverage. C.D.O.’s are, in essence, leverage on leverage, but this is a complicated, technical, and largely semantic argument. The surface intuition is that taking a levered position increases your return if nothing defaults, but less has to default for the buyer to lose money.

- C.D.O.’s were used to finance bonds or other debt positions. “How?” is what I heard you say, in the back? Well, think about it this way: an investment bank requires 50% of the purchase price of a set of bonds and charges LIBOR+100bps on the other 50%. We say that you’ve financed the purchase of the bonds two to one at a rate of one hundred basis points over LIBOR. Now, using our example, let’s say one could issue a C.D.O. and sell enough bonds to get 50% of the purchase price of the underlying bonds up front. Let’s also assume that the liabilities have a weighted average interest rate of LIBOR+10bps. Using the C.D.O. instead of a traditional loan, especially since the C.D.O. can’t be cancelled like a loan can and, most likely, contains much more lax terms than a loan, is much more cost effective. Taking this a step further, it was even possible for C.D.O.’s to be issued that allowed more bonds to be put into the C.D.O. or allow bonds that were sold to be replaced. This effecive made the C.D.O. a credit line with an extremely cheap interest rate. Keep in mind the “equity” or “most levered tranche” or “bottom” of the C.D.O. generally was structured to have a very high return, somewhere in the 15-25% range.

Also, the backdrop of the boom in C.D.O.’s, don’t forget, was a very low rate environment. If one could get LIBOR+10-15bps on AAA bonds when rates were, in 2004 for example, 1% (for USD LIBOR and the Fed Funds), that was a major out performance for a AAA security (AAA, how much risk could there be?!).

Now that the historical context is out of the way, it seems pretty clear that some of these reasons for isssuing C.D.O.’s will not diminish in importance. Funds and money managers will always need more yield. Investors that are smart about credit analysis will always want to take the risks they understand and get paid for taking said risks. Funds and other “levered players” will always need financing. So, let’s examine how the landscape changes rather than disappears.

- Complexity will die. There are a number of reasons for this. Part of the reason is that buyers of C.D.O.’s will begin to realize that structure adds a layer of complexity that no one really can grasp fully. Why have dozens of triggers and tests at every stage of the waterfall (the way cash is distributed in order of seniority)? In some deals, I’m sure, this complexity helped some tranches of the C.D.O. In some other deals, I’m sure, this complexity hurt some tranches of the C.D.O. The one constant is that it’s nearly impossible to tell the right levels and specific mechanics beforehand. Hence the complexity will die and structures will simplify. Likely this also means less tranches. Why have a $4 million tranche size in a $400+ million deal when you can’t even predict losses within an order of magnitude (1%, 9%. or 20%? Who knows?!)? This is hardly a new concept, I introduced it already when discussing residential mortgages.

- Arbitrage C.D.O.’s will reign supreme. This one is controversial, and the term “Arbitrage C.D.O.” almost takes on a different meaning each time it’s defined. The intuition, though, is that a hedge fund taking advantage of a market dislocation by issuing a C.D.O. is an “Arbitrage C.D.O.” Why will these be popular? Well, C.D.O. shops, or firms that are serial issuers of C.D.O.’s, have mostly blown up and are done. Traditional money managers will be shying away from C.D.O.’s for a long time. So, in order to sell the C.D.O. equity, the most levered risky piece, the firm issuing the C.D.O. will need to also be willing to take on the equity–this leaves only hedge funds. Arbitrage C.D.O.’s also come together more quickly and generally are backed by corporate bonds. Funds and other accounts that, as a core competency, already analyze corporate credit won’t have to go “outside the comfort zone” to buy into arbitrage C.D.O.’s.

- C.D.O.’s or C.D.O. technology will become part of the M&A world more and more. Aha! Maybe too clever for my own good, but while all these specialty finance companies used to be able to issue a C.D.O. for funding purposes on their own, now they will need an investment bank to connect them with hedge funds or take on the debt, and thus the risk, themselves. These C.D.O.’s will likely be simple too (see #1), but will be an efficient way for these companies to finance assets or move them off the balance sheet. Here’s an example: a diversified finance firm, with a large lending presence, for example (most likely with a R.E.I.T. subsidiary, a popular structure of the past eight years) will be looking to sell itself. However, because the assets on it’s balance sheet look risky the leveraged finance groups will need to arrange some financing against those assets. The structure? Most likely a C.D.O. with hedge funds providing the cash and getting a “juiced” return on their money. This is essentially the covered bond product, but with an extra layer of complexity (tranching) on top.

Okay… that’s enough prognosticating for now. Still deciding which product is next. Drop me a line if you have a favorite!

Disclosure? I Call B.S.

August 20, 2008Disclosure and financial filings seem to be topical today with the S.E.C. announcing the Investment Banking Analyst Mercy Initiative. So, I’ll play ball. I have read a bunch of things recently making claims about the ability of a diligent investor to know what they are “getting into” and what the risks are for investing in a public company that has disclosure requirements. Actually, I haven’t been doing this for decades, so let’s quote someone that has… Tom Brown:

No one, inside or outside the company, could accurately predict what … ultimate losses would be. But what they could do—and what financial services investors can do now, regarding the banks in general–is make reasonable estimates of ranges of losses, and estimate companies’ future earnings power, then compare that to their market values.

(emphasis mine).

I emailed Tom to clarify a few thing, but never heard back. So, as I am prone to do, I’ll assume I’m correct in my interpretation and move on. I’m assuming that this was also the case in the past–how else would people be able to buy into a financial institution in the past if Tom didn’t think his words were just as true two to three years ago? (Nothing has really changed in disclosure requirements, right?) Surely, in the past, the issue would have been taking a view on the performance of the various financial institutions’ assets as well.

I looked at three firms’ disclosure, from 2006, related to C.D.O.’s … what I could find. Now, in the interest of full disclosure, I’m not trained to do this. I’m just a person, with some financial experience, looking at some S.E.C. filings. I knew i was looking for C.D.O. exposure, especially in the context of figuring out what banks would need to be responsible for if the market had a severe dislocation. Let me explain what I mean by this. Remember all the liquidity put chatter? While mostly related to S.I.V.’s, this is still a relevant concept for C.D.O.’s. As in any syndicated deal, most common for selling bond or stock offerings related to corporations but also relevant for securitized products, when an investment bank agrees to do a securitization they have most likely (call it 80+% of the time) agreed to “take down” or purchase the securities they are unable to sell to investors. Easy enough, right? Those assets are what has generated a huge amount of writedowns. It’s very easy to see the relationship between market share in the C.D.O. and securitized products space and magnitude of writedowns.

These relationships, however, are very complex. Multiple investment banks could be selling an individual deal and each could be responsible for purchasing different parts or different percentages of leftover securitizations. These are individually negotiated for each transaction. As a firm is building up assets (for example, sub-prime mortgage-backed securities), before they have enough to actually securitize and create a C.D.O., the bank/investment bank could have all the risk of those assets losing value or defaulting–if the C.D.O. doesn’t get done then it becomes a big problem. It’s also a big difference what types of assets or structures make up the C.D.O. securities. One sees the problem growing. There is a lot of information that needs to be processed to come up with a reasonable estimation of losses. I would claim that it is completely insufficient for a bank, as they have been, to disclose exposures once they start to become a problem.

So, what did I find? Terrible disclosure. I was able to find almost no information. Certainly no information that would have helped come up with an estimate for losses from these firms based in any sort of logic or fact. Now, I’m not saying one should be suspect of current disclosure–I don’t know what is next to blow up or cause big problems and none of these firms are run by the same regime that decided the previous level of disclosure. What I am saying is that I wouldn’t have been able, even if I had known exactly what was going to happen, to know the magnitude of the losses.

First, I looked at Citi. Citi had a notion of participating or structuring. Those numbers were combined and reported together. This helps to determine market share, perhaps. This does nothing to disclose the risk on the balance sheet. This number ($110 billion) could be made up entirely of bonds were Citi is at risk. It could also be entirely made up of bonds where Citi has no risk and is taking fees. There is nothing I found in the 10-K’s to say anything more helpful. So we know losses, if these C.D.O.’s (named V.I.E. or Variable Interest Entities in the disclosure) were sold at 22 cents on the dollar, as Merrill reportedly did, the losses would have been between zero and $86 billion. Whew! Nailed it down… Now, knowing that, do you buy or sell Citi’s stock?

Second, I looked at Merrill. They state some numbers and then footnote saying they might, potentially, hold a financial interest in some of the securitizations. Same situation as Citi. No disclosure as to what kinds of bonds these are. How much was retained? How much in financing obligations exist related to these? What percentage would have had to be retained by Merrill if unsold?

Last I looked at Bear’s filing. Bear was a slight improvement. They actually stated some of what they retained and have some exposure numbers which one could back out some other information from. Still, if I was modeling the losses I would be asking for a lot more information–while an improvement, in my opinion, it wasn’t enough.

Below are the tables from the various filings. Also, if one was looking for C.D.O.’s, I put the number of instances the term of interest appeared.

Now, since the S.E.C. is mandating and revamping filings and disclosure, perhaps they can do something about this. Maybe financial firms should be forced to disclose risk numbers and sensitivities. I certainly don’t have all the answers, but I think it’s pretty clear that no one had the answers, nor did they have the specific questions, before this crisis occurred.

From the Citi 10-K (2006):

Mentions of the word C.D.O. : Thirteen (lucky!)

From Merrill’s 10-K (2006):

Mentions of the word C.D.O. : Zero

From Bear’s 10-K (2006):

Mentions of the word C.D.O. : Eight

Assume all Bonds are Spheres: Part I

February 14, 2008This segment is a regularly occurring feature. It gets its name from a joke that is commonly made about technical people. Usually a very simple problem is presented about horses (or sometimes cows) and a physicist/engineer/mathematician is asked to provide a solution. The solution is made complex because incorporating the nuances of the animals in question is extremely difficult, hence the highly technical person is required. The solution then starts with the technical person saying, “I made two assumptions. The first assumption is gravity. The second assumption I made was that all horses are spheres.” The crux of the joke, which is often found in the markets, is that approximating is both easier and “accurate enough.” Hence the naming of this series on mathematical financial tricks and other interesting tidbits.

Loans are simple enough. I tell you that I would like to originate a loan, which I will securitize, and your interest rate on a loan is going to be 10%. Easy! You just send in 10% of the loan amount every year. Well, not really:

- If I followed convention, I quoted you an Act/360 rate (it accrues yearly based on the actual days, but assumes a 360 day year)–the interest you pay is really 10.14% (~ 365/360 * 10%). (Note that the lower the interest rate, the lower the impact of converting to Act/360.)

- If this was a 10 year loan, those 14 basis points (bps, 1/100th of a percent) are worth about 1.11% of the total notional of the loan (don’t forget, that’s 14 bps extra one pays per year, for 10 years–take the present value of all those cashflows).

Now, let’s look at what happens when I securitize the loan.

- I monetize the 14 bps because the bonds I sell accrue on a 30/360 basis (market convention), so those extra days of interest never get paid to bondholders–I keep it.

- Another nuance: The bonds are priced to the market convention, which is assuming a semi-annual yield. Investors will demand, say, a 10% coupon on their bonds. The bonds, though, match the loan–they pay monthly. What is the 10% worth on a monthly basis? About 9.80% (see below). What do I earn on arbitraging the difference? Well, about 20 bps per year, which, present valued, is worth about 1.59% of the loan amount.

Let’s review: I quoted you a loan at 10%. The 10% tuned out to be more than 10%. I then sold the loan using a completely different set of assumptions and, doing nothing at all, managed to pocket 2.7% of the loan amount. On $10 million dollars that’s $270,000 I made just for arbitraging various conventions and the difference in how bond investors think and how lenders generally think. Would you have been better off to take the 10.05% loan from the insurance company, quoted on a 30/360 basis? Yep. But the rate was lower … and all bonds are spheres.

————————–

The voodoo behind the 9.80% monthly equivalent coupon is easy. The first insight is to recognize that a yield is essentially a discount rate. To find a monthly equivalent to a semi-annual yield one needs only to find the interest rate that, when compounded twelve times a year, equals the yield that assumes compounding twice a year (the semi-annual yield).

We start by saying that an annualized yield, assuming compounding x times a year is

(1 + i/x)^(x) – 1 = annualized yield Formula that codifies the above intuition.

For our example of a 10% semi-annual yield, we get the following:

ann. yield (12 pmts.) = ann. yield (2 pmts)

(1 + (r/12))^12 – 1 = (1 + (10%/2))^2 – 1

1+ (r/12)) = (1+5%)^(2/12) Algebra… 😦

r/12 = (1.05)^(2/12) – 1

r = 12 * ((1.05)^(2/12) – 1)

r = 9.79781526% Our answer!

And that’s how I arrived at that solution. I’m sure I’m missing something minor that excel would do for me, but you get the idea.