Charlie Gasparino Still Doesn’t Understand

I recently wrote a piece about Goldman Sachs an took issue with some things Charlie Gasparino had said. He felt it was necessary, then, to write something about m article, but not really respond to it. It should come as no surprise that Mr. Gasparino’s response is as devoid of content as his original piece. I go through it here, line by line (my responses are in bold):

Why a Business Writer Wishes Wall Street Wasn’t Such a Big Story

Could it be because of the scrutiny that now is focused on the author of this missive?

I’ve been covering Wall Street now for nearly 20 years, and it’s been a pretty good run. I’ve broken some big stories and written three books about the “Street,” and I’m looking to write another. I’ve made some friends along the way — people like Teddy Forstmann, the great investor who called the junk-bond crisis and had the insight to steer clear of several others, and I’ve made some enemies, namely the traders and bankers who work at many of the big firms who would have preferred I kept silent about their problems during last year’s financial crisis rather than blab about them on CNBC.

I find this the source the mainstream media’s greatest power and the cause of their greatest weaknesses. Notice that Mr. Gasparino makes his success a function of how many stories he has broken. Did he get them right? Well, given his propensity to report gossip, merely skim the surface, and follow the meme of the day when giving his opinion, perhaps he’s just picking the most favorable metric.

The story about Wall Street is a big one — and I’m afraid to say, it’s going to get bigger in 2010 and beyond. If you want to know why the federal government allows all those community banks to fail, but bails out Citigroup, Bank of America, etc., with unlimited funding, it’s because these institutions have grown so large, and become so important and intertwined in the global financial system, that letting them fail would be catastrophic. In other words, it’s cheaper to guarantee Citigroup’s survival (and that of Goldman Sachs, Morgan Stanley, Bank of America, JP Morgan) with hundreds of billions of dollars in bailout money as the government did last year, than watch the global banking system implode.

Honestly, I have no problem with this paragraph’s message. Too big to fail is a true problem and it evokes a lot of populist rage. I’m inclined to question his motives for putting this here, but I’m going to give him the benefit of the doubt (there’ll be plenty of opportunity to pick on actual errors, faulty logic, and cherry-picking later).

Now you may think I just can’t wait to cover this story in 2010. Of course, the journalist in me says, “bring it on”: another book and columns to write, big stories to cover. But the American citizen in me makes me wish Wall Street wasn’t such a big story, that people like Vikram Pandit of Citigroup and Lloyd Blankfein of Goldman Sachs (yes, the guy who thinks trading bonds is “God’s Work”) just weren’t such a big part of American life that the country’s economy rises and falls on their bad bets.

This last part makes no sense at all. So, American citizens merely want the media to stop covering Wall St. or cover it less? And it’s because Goldman and Citi are big parts of the “American life” that the economy rises and falls on their bad bets? In the interest of being charitable, I’ll just assume that he meant to say that he wishes that the events causing the story weren’t as severe as they have turned out to be and that the problems, not just the focus wasn’t all that big. You’re welcome Charlie.

I’ve come to this conclusion after reading two articles. One is a thoughtful but at bottom unrealistic piece written by several HuffPost contributors, including Arianna Huffington. It proposes that Americans remove their money from the large money-center banks at the center of the reckless risk taking that led to last year’s meltdown and bailouts, and move their deposits into community banks, the good guys of finance that didn’t take the risk because they weren’t Too Big To Fail.

Interesting that he likes this piece, but thinks it’s unrealistic. It’s like damning with faint praise. I also think he needed an article to say something positive about, so why not the one written (at least partially) by the person who distributes his writing to the masses?

The other is a less thoughtful post written by an anonymous blogger also on this site that defends Goldman Sachs and questions some of my reporting, including one piece from The Daily Beast that suggests Goldman’s all-too-obvious image problems have begun to impact its investment banking business.

Ahhhh… and here it is. My piece is being called less thoughtful by Charlie Gasparino? That’s like me calling a fish a bad swimmer. Further, he says that I defend Goldman Sachs. Can we all pause for a moment and reread the headling of the post, written by me, that he cites? It is, “2010 Will be Challenging for Goldman Sachs”–how he translates my thesis, that next year will be an uphill battle for Goldman, as defending Goldman is still totally unbelievable to me. As a matter of fact, it implies that he doesn’t understand the piece at all. Now that, I believe.

As for his questioning my conclusion that there is no evidence that Goldman’s investment banking business has been materially hurt by their image problems, well… I cite the league tables in the original article. Further, this shouldn’t even matter all that much since such a large percentage of Goldman’s profits come from their trading and principal investing (again, in the numbers, and the exact point of my article).

What I like about Arianna’s piece is that it attempts to hold the bad guys responsible. Its point is pretty simple: The likes of Citigroup and Bank of America don’t deserve our money, so let’s hit them hard and reward those who deserve our support, namely the community banks, who, despite many failures, didn’t engage in massive risk taking as the so-called large “money center” banks did over the past decade. The problem with the piece is twofold: First, community banks weren’t blameless in terms of risk taking and thus aiding and abetted the real estate bubble, which is the root cause of our economic problems. That’s why so many of them have failed and will continue to do so. Also, by making smaller community banks more important we might simply transfer the policy and status of Too Big To Fail to a different set of institutions. Armed with government support and subsidy from the Too Big To Fail precedent, what would stop community banks from taking excessive risk just as Citi has done?

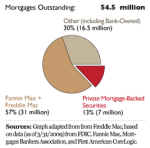

This paragraph is just silly. So, community banks are going to create hundreds of billions of dollars in CDOs? Could it be that smaller banks have failed because credit froze and they don’t have sophisticated hedging operations? Could it be that small banks have failed because they have loans as their primary assets and when the economy begins to have problems less people pay back their loans and banks take losses? Or, it could just be because they aided the real estate bubble. Although… Let’s take a look at this graphic from this ProPublica story (chopped a bit by me):

(Click for a larger version.)

Oh, right… If a small, community bank owns some mortgages, it means those mortgages weren’t securitized, and, thus, weren’t part of the massive overhang of toxic CDO assets that were made up of securitized mortgages. Finding this information cost me approximately five minutes on Google.

There are almost too many ways to attack the posting from the anonymous blogger (who goes by the name “Dear John Thain”), titled “2010 Will be A Challenging Year for Goldman Sachs,” (this guy obviously has a flair for understatement) so I will make the following points.

My comments will be more frequent now, as he’s getting to the good stuff. So far, all he says is (1.) the problems with my “posting” are numerous and (2.) I understated the problem in my title. He also promises to make multiple points…

Because he’s anonymous, we don’t know if he’s a Goldman executive (one way Goldman is now looking to attack its critics is by blogging positively about the firm, I am told) an investor with holdings of Goldman Sachs stock (a substantial conflict of interest if this is true), or just some guy with too much time on his hands.

This part is stupid, baseless, and implies Mr. Gasparino is backed into a corner. First, let me end this discussion now and forever by making the following statement: I am not now, nor have I ever been, an employee of Goldman Sachs or any of its subsidiaries. Further, I own no financial interest in Goldman or any of its subsidiaries. Second, I dare Mr. Gasparino to produce one shred of evidence, a comment on the record, or anything else indicating that Goldman is indeed using bloggers to defend them (Mr. Gasparino apaprently defines “blogging positively” as pointing out that Goldman almost certainly can’t reproduce its strong 2009 in 2010, as I did).

Beyond the mere infirm grasp of reality, this is where I think everyone who likes the blogosphere keeping the mainstream media honest, and indeed the blogosphere itself, should be deeply offended by what Mr. Gasparino has done. Mr. Gasparino has resorted to a sort of McCarthyism where insinuating someone who doesn’t wish to divulge their own identity is planted her by Goldman–a firm better known for suing bloggers than spawning them. This is insulting and should not be tolerated by any thinking person. The people who know the most about finance are the people who work in it. I make zero dollars from my blog and my writing. So many others risk their futures and livelihoods by writing, only to explain what is actually going on to those that are interested.

In fact, Charlie Gasparino, and his ilk, are the reason we exist. If he didn’t have the accuracy of a backfiring gun when it comes to issues other than gossip we, the pseudonymed finance writers, wouldn’t be needed. The public would understand financial topics much better and the record wouldn’t need to be set straight by those in the know. And now, when faced with someone correcting him on the record, he merely wishes to dismiss the facts and figures put before him and insinuate something for which he has no facts. Honestly, this speaks volumes about his regard for the truth and his ability to justify his own words when challenged.

This sort of attack should be rebuked as swiftly and sternly as it was introduced.

In any event, one line caught my eye: He takes issue with my assertion that Goldman benefits from a subsidy from the government because of its status now as a bank; he says it’s really a “financial holding company” as opposed to a “bank holding company” but fails to point out that there’s really no difference.

Honestly, Mr. Gasparino should either stop saying patently false things and merely learn to read. There is a major difference. Banks have stringent capital requirements. Financial holding companies do not. Let me pose a simple question, keeping in mind the distinction I just made. Is a financial holding company that owns a bank and a broker-dealer (the broker-dealer having a $1 trillion balance sheet) the same as being a bank with a $1 trillion balance sheet? Absolutely not. Banks cannot own certain sorts of assets, don’t have trading portfolios that need to marked to market every day, and are severely limited in terms of how much leverage they can take on. A broker-dealer, however, can take much riskier positions, can be more leveraged, and have different accounting rules (in addition to costs of funding). Mr. Gasparino did get one thing right, I failed to point out something that was patently false.

In the aftermath of the financial meltdown and bailout, Goldman is now primarily regulated by the Fed (as opposed to the Securities and Exchange Commission), the banking system’s chief regulator, and receives along with that all the benefits of the classification, including being treated in the market as Too Big To Fail, and thus being able to borrow cheaply.

Goldman the “financial holding company” is regulated by the Fed. Goldman’s bank is regulated by bank regulators. Goldman’s securities businesses are regulated by securities regulators. This is why people working inside large “financial supermarket” institutions have heard the expression “bank chain vehicle” and similar terms, the regulator for a specific division matters.

Here’s another fun fact that shows Mr. Gasparino has no idea what is saying: Goldman Sachs has had cheaper costs of borrowing (as shown by their credit default swaps) than Citi, the ultimate example of being way too big to exist.

As I pointed out in my book The Sellout, there’s much to admire about Goldman and its history in risk taking compared with the other big firms; this was, of course, the only firm to question its own irrational exuberance and short the subprime real estate market back in late 2006 (a trade in which a firm makes money if prices decline) whiles it competitors were betting bigger on the bubble. But that hedge only delayed the inevitable — Goldman, like the rest of the financial business (except maybe JP Morgan), bet big and wrong, so wrong that by the fall of 2009 it, along with most of its competitors, was falling into insolvency.

Fall of 2009? So, I guess the billions in profit Goldman reported for the third quarter of 2009 was all smoke and mirrors. Maybe he means 2008? Or maybe he’s more confused about what he wrote than I am.

All of which brings me to the bigger point of this piece: We as journalists, as commentators, and policy makers spend way too much time arguing over the fine points of Goldman’s status as a bank holding company or a financial holding company. Lloyd Blankfein is pilloried for saying he does God’s Work when he trades stocks or bonds, when in a more perfect world, what he says or what he does just shouldn’t mean that much to the guy who owns an auto repair shop in Queens or the family farmer in Iowa.

Charlie Gasparino, lumping himself in with policy makers, is being charitable. I want the people who make the law to argue over whether or not certain institutions should be allowed to employ certain types of corporate structures. I want the actual facts to be part of the public discourse and guide policy. Given the errors Mr. Gasparino tends to make, I can see why arguing over the specifics wouldn’t hold much appeal.

That’s why I kind of like Arianna’s idea (despite its drawbacks) of empowering community banks as opposed to the money center banks that are way too important and powerful and whose leaders just shouldn’t wield that type of influence because at bottom they’re just not smart enough — nor, perhaps, is anyone. Dear John Thain’s nom de plume is a reference, of course, to the former CEO of Merrill Lynch John Thain, who by all accounts didn’t think twice about spending more than $1 million decorating his office during the financial crisis, including tens of thousands on a high-end commode.

Make no mistake, the reference to John Thain “tricking out” his office has no place in the discussion. If Mr. Gasparino can’t take the time to read my About page, then at least he did as much research on me as he did for his actual articles.

To be sure, bankers have always wielded enormous power in our society — JP Morgan was a real person, after all. But somehow the importance of people like John Thain (whose spending spree also included a $1,400 parchment paper waste basket) and Lloyd Blankfein has grown beyond anyone’s comprehension, even their own. When former Lehman Brothers CEO Dick Fuld was rebuffing offers to buy his firm before its free fall into bankruptcy last year, I don’t think he truly envisioned the power of his inaction: That the entire financial system would shut down as a consequence of holding out for more money. One of the great lessons of the financial crisis is that this power was bestowed on the wrong people — the people who helped foment the housing bubble (along with the government) by packaging all those risky mortgages into allegedly safe bonds and then took so much risk that they destroyed the financial system and created the Great Recession and with it 10 percent unemployment.

Amazing. Once again he references John Thain’s excessive decorating budget. This is about as useful as me accusing Mr. Gasparino of being a murderer because his first name is the same as Charlie Manson. The other points in the paragraph are actually true: financial C.E.O.’s have a lot of power and have a huge impact on our financial system. This is why their industry is heavily regulated. The ending of his rant, about “the wrong people” and all that, is nonsense and vague. I’d dissect it further, but I’m tired.

It would be nice if in the not so distant future the Dick Fulds and Lloyd Blankfeins of the world become less important, even if I lose a book deal in the process.

I, too, think it would be nice if Mr. Gasparino had less of an opportunity to be in the public eye. But then again, I bet you already knew that.

Explore posts in the same categories: Blog, Finance, Financial Institutions, Information, Media, Miscellany, People, Risk, StructureTags: Dear John Thain, earnings, financial media, financial news, Gasparino, Goldman, Goldman Sachs

You can comment below, or link to this permanent URL from your own site.

January 5, 2010 at 7:07 am

I’m not a blogger, but I often make comments on blogs that defend Goldman Sachs. I’m constantly accused of being a Goldman employee. I’m not. I’ve never worked for a financial firm, and have never owned a financial stock of any kind. I take the ridiculousness of their attack as one measure of the weakness of their case against Goldman. As for Charlie, I suspect what he up to is partisan politics and nothing else. GS is the best, and they have always had a large number of Democrats in their upper management and he can’t stand it – violates his supremely stupid worldview.

January 5, 2010 at 9:31 am

[…] the people who work in it. Written by Chris F. Masse on 2010/01/05 — Leave a Comment Which is why pseudonymed finance writers are needed. Posted in Ethics, Finance, Journalism | Tagged bloggers, Finance, finance bloggers, finance […]

January 5, 2010 at 10:03 am

Well said, keep it up.

January 5, 2010 at 11:28 pm

Dear John Thain,

I love you man. No one as pegged Gossiparino better than you. In reading your blog and others, I have discovered a few additional Gasbag avenues that you should explore:

One blogger suggests that Lloyd thinks that Chazzy is so stupid that he is an embarrassment to his profession. So, he engaged one of his brighter young ladies to research this phony. She discovered that the dope had his wife, brother, lawyer and others plant false book reviews on Amazon to hype his pathetic book. Lloyd then allowed it to leak that he was asking for Gasparino’s resignation for alledgedly falsifying book reviews (what the hell, Chazzy called for LB’s resignation for stating the truth!).

Many of us have noticed that we have not seen Gasbag on CNBC in a very long time. Question: has he been fired by CNBC? Maybe they benched him? Maybe he is in rehab? And, how is it possible that a man who can barely complete a sentence is hosting a radio show? Desperation?

Perhaps CNBC has been humiliated by the failure of “the Sellout” which has now fallen below 1,500 on the Amazon list(Too Big to Fail is now #20! and there are 5 other books about the financial crisis that are kicking the shit out of the Sellout). With all that CNBC promotion, they must feel embarrassed that the Sellout has become the Brownout.

Finally, sources at Harper Collins are pissed that so many books are being returned after the Christmas season (How funny that the Sellout can’t Sell Out). So, as Gossiparino mentions in his article about you, he is seeking a new book deal. Do you think that HC has the stomach to loose more money on this illiterate? Not likely. Perhaps Marvel could publish it (as in Comic Books).

January 6, 2010 at 11:24 am

Dear John Thain,

I love you man. No one as pegged Gossiparino better than you. In reading your blog and others, I have discovered a few additional Gasbag avenues that you should explore:

One blogger suggests that Lloyd thinks that Chazzy is so stupid that he is an embarrassment to his profession. So, he engaged one of his brighter young ladies to research this phony. She discovered that the dope had his wife, brother, lawyer and others plant false book reviews on Amazon to hype his pathetic book. Lloyd then allowed it to leak that he was asking for Gasparino’s resignation for alledgedly falsifying book reviews (what the hell, Chazzy called for LB’s resignation for stating the truth!).

Many of us have noticed that we have not seen Gasbag on CNBC in a very long time. Question: has he been fired by CNBC? Maybe they benched him? Maybe he is in rehab? And, how is it possible that a man who can barely complete a sentence is hosting a radio show? Desperation?

Perhaps CNBC has been humiliated by the failure of “the Sellout” which has now fallen below 1,500 on the Amazon list(Too Big to Fail is now #20! and there are 5 other books about the financial crisis that are kicking the shit out of the Sellout). With all that CNBC promotion, they must feel embarrassed that the Sellout has become the Brownout.

Finally, sources at Harper Collins are pissed that so many books are being returned after the Christmas season (How funny that the Sellout can’t Sell Out). So, as Gossiparino mentions in his article about you, he is seeking a new book deal. Do you think that HC has the stomach to loose more money on this illiterate? Not likely. Perhaps Marvel could publish it (as in Comic Books).

January 6, 2010 at 6:15 pm

I don’t get it. Why was my comment taken down?

January 7, 2010 at 1:48 pm

[…] he makes one statement that is patently false. I’ll quote here both his line and the matched part of my response from my blog (my response is in bold): In any event, one line caught my eye: He takes issue with my assertion that Goldman benefits from […]

January 11, 2010 at 5:40 pm

Dear John Thain,

Two things for you today.

One, Gossiparino’s pathetic book made a mysterious jump of 1,000 points to around 400 on Amazon this morning. Hmm, all in one day? Me thinks that the Gasbag has arranged a phony large buy to mask his plummeting sales while he is trying to negotiate a new book deal. If this sounds familiar, it is comparable to the phony book review posts he has had relatives place on Amazon.

Two, John Thain on Bloomberg talking about compensation today. This is like OBL talking about public safety; or Jesse James talking about bank security; or Gasbag talking about finance and communications.

May 25, 2010 at 1:05 pm

Does anyone on CNBC ever understand? I mean Jim Rogers consistently goes on the show and educates them and they are befuddled as to what he says. Contra-investors like Peter Schiff, Marc Faber and Gerald Celente always confuses them!

August 12, 2010 at 12:28 pm

I drew Simple Charlie after watching him last night.

http://tomasestradapalma4today.blogspot.com/